‘Dwellings built specifically for those on incomes that deny them the opportunity to purchase or rent on the open market’ (Pacione, 2009, p.196)

by topics

Topic: Housing issues and policy

C

Central Provident Fund

‘The Central Provident Fund (CPF) is a comprehensive social security system that enables working Singapore Citizens and Permanent Residents to set aside funds for retirement. It also addresses healthcare, home ownership, family protection and asset enhancement.’ The savings plan for working Singaporeans and permanent residents primarily to fund their retirement, healthcare, and housing needs. The CPF is an employment based savings scheme with employers and employees contributing a mandated amount to the Fund. (Central Provident Fund Board, 2019)

D

Debt-to-income

‘The debt-to-income (DTI) ratio is a personal finance measure that compares an individual’s debt payment to his or her overall income.’ The debt-to-income ratio is one way lenders, including mortgage lenders, measure an individual’s ability to manage monthly payment and repay debts. DTI is calculated by dividing total recurring monthly debt by gross monthly income, and it is expressed as a percentage.’ (Murphy, 2019)

D

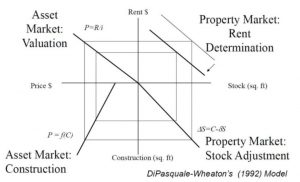

DiPasquale-Wheaton Four-Quadrant Model

G

Green building

‘Green building is a practice of reducing the environmental impact of buildings and enhancing the health and wellbeing of building occupants by:

- Planning throughout the life-cycle of a building or a community, from master planning and siting to design, construction, operation, maintenance, renovation, and demolition with a focus on the impact to both the environment and people.

- Optimising efficient use of energy, water, and other resources to avoid overconsumption and adopting the use of renewable energy and eco-friendly materials to minimise carbon footprint and emission.

- Reducing the production of waste and preventing pollution of areas like water, air, noise and land.

- Enhancing indoor environmental quality through natural ventilation and lighting as well as good indoor air quality by design and other means.’

(Hong Kong Green Building Council, 2019)

H

Home Ownership Scheme

A subsidized-sale housing programme managed by the Hong Kong Housing Authority. It was instituted in the late 1970s as part of the government policy for public housing with two aims - to encourage better-off tenants of rental flats to vacate those flats for re-allocation to families in greater housing need; and also to provide an opportunity for home ownership to families unable to afford to buy in the private sector. (Home Ownership Scheme, n.d.)

H

Housing affordability

‘The term ‘affordable housing’ describes housing that assists lower income households in obtaining and paying for appropriate housing without experiencing undue financial hardship (Milligan et al 2004, pi). A range of publicly or privately initiated forms of housing may meet this specification (Milligan et al 2007, p27). In fact, in recent years, the term ‘affordable housing’ has been used as an alternative to terms such as ‘public’, ‘social’ or ‘low cost’ housing (Gabriel et al 2005, p6). That said, in the Australian context, there is no single accepted definition of what constitutes affordable housing (Milligan et al 2004, pi). ‘ (Urban Research Centre, 2008, p.9)

H

Housing bubble

‘A housing bubble is a hike in housing prices fueled by demand, speculation and exuberance. Housing bubbles usually start with an increase in demand, in the face of limited supply, which takes a relatively extended period to replenish and increase. Speculators enter the market, further driving up demand. At some point, demand decreases or stagnates at the same time supply increases, resulting in a sharp drop in prices — and the bubble bursts.’ (Kenton, 2019)

H

Housing policy

‘The housing policy environment is the set of government interventions that have a critical and measurable effect on the performance of the housing sector.’ (Angel, 2000, p.11)

H

Housing Provident Fund

‘The Chinese government has designed the Housing Provident Fund to help middle and low-income workers meet their housing needs. When employers fail to contribute, workers are denied the funds they are due to help them with the rent, maintenance, or purchase of their home. For this reason, the FLA expects that affiliated companies sourcing from China require full payment of Housing Provident Fund contributions.’ (Fair Labour Association, 2015)

H

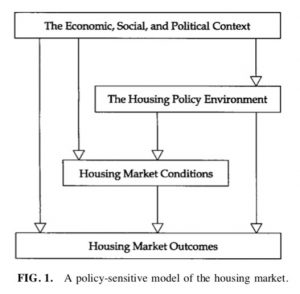

Housing Sector Policy-Sensitive Model

The model ‘provides a schematic of the relationships between the housing policy environment on the one hand, and housing market outcomes on the other. Both policies and outcomes exist in a broader economic, social, and political context, and relate to the key conditions affecting the housing market. The overall economic, social, and political context of the housing market affects housing market outcomes both directly and indirectly. The housing policy environment also affects housing market outcomes both directly and indirectly.’ (Angel, 2001, p.179-180)

H

Housing subsidy

‘Under the Housing Subsidy Policy, households who have been living in public rental housing or interim housing for 10 years or more are required to declare household income biennially.’ (Information Services Department, 2008)

I

Inflation

‘Inflation is a quantitative measure of the rate at which the average price level of a basket of selected goods and services in an economy increases over a period of time. It is the constant rise in the general level of prices where a unit of currency buys less than it did in prior periods. Often expressed as a percentage, inflation indicates a decrease in the purchasing power of a nation’s currency.’ (Chen, 2019)

L

Linked Exchange Rate System

‘The Linked Exchange Rate System was established in 1983. It is in essence a Currency Board system, which requires both the stock and the flow of the Monetary Base to be fully backed by foreign reserves. Any change in the size of the Monetary Base has to be fully matched by a corresponding change in the foreign reserves.’ (Hong Kong Monetary Authority, 2018)

L

Loan-to-value

‘Loan-to-value (LTV) ratio is an assessment of lending risk which financial institutions and other lenders examine before approving a mortgage. Typically, assessments with high LTV ratios are higher risk and, therefore, if the mortgage is approved, the loan costs the borrower more. Additionally, a loan with a high LTV ratio may require the borrower to purchase mortgage insurance to offset the risk to the lender.’ (Hayes, 2019)

M

Mortgage interest reduction

‘Mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on any loan used to build, purchase or make improvements upon their residence. The mortgage interest deduction can also be taken on loans for second homes and vacation residences with certain limitations. The amount of deductible mortgage interest is reported each year by the mortgage company on Form 1098. This deduction is offered as an incentive for homeowners.’ (Kagan, 2018)

P

Pre-sale arrangement

‘Obtaining a pre-sale distribution agreement is one of the best ways of getting financing for the picture. This is an effective financing tool, because the foreign distribution agreement is a form of security for investors. The filmmaker is generally required, as a condition of the pre-sale agreement, to obtain a completion bond (an insurance policy covering the cost of completing the film if the filmmaker is unable to do so).’ (HRBEK Law, 2019)

P

Price-to-income ratio

‘The concept of price-to-income ratio is used to measure the affordability of homes in a certain area. When banks and financial institutions extent home loans, they consider the price-to-income ratio to assess how affordable it is to the home loan seeker. The price-to-income ratio is generally known as attainability. It is especially used to measure the long-term affordability of homes in a region. The price-to-income ratio is also a good parameter to judge the current affordability of homes in a region relative to how affordable it historically was. If the price-to-income ratio is going up, it means that homes are becoming less affordable. If the price-to-income ratio is declining, it means that homes are becoming more affordable.’ (Proptiger, 2015)

P

Property cycle

Property cycle can be divided into 4 phases:

- Stable opportunity stage is ‘the opportunity phase is where prices are stable, leading many people to believe it’s a good time to invest. Those that understand the property cycle will also identify that this is the start of an upswing in the property market that will see prices rise. Because of this, it is widely deemed a bad time to sell.’

- The growth phase sees property values begin to increase slowly as vacancy rates fall and rent prices start to rise as investors see the potential in an area. This phase sees opportunities appear more clearly, but not as clearly as they will in the peak phase. Interest rates are usually low and it tends to be easier to get finance in the early stages of the growth phase. Value will usually start to grow in inner city suburbs and those near the beach. A ripple effect will then see growth expand to middle suburbs and finally to outer suburbs. The middle of the growth phase is often seen as an excellent time to invest as property is still relatively affordable, yet favourable returns are conceivable as the cycle advances into the peak phase.

- Peak phase is ‘usually the shortest and can often feel quite frantic as vendors push up demand and investors flood the market, competing to make the most of this rapid growth. Eventually the peak phase fizzles out as builders, developers, developers and home-owners flood the market with properties leading to an excess in supply.’

- ‘This results in what is known as the fall or slump phase. With too many investment properties on the market, vacancy rates increase, rental returns begin to decrease and prices stabilise (or even drop). This phase can be stressful for new investors who bought during the boom phase, only to struggle with repayments as investment returns decrease.’

(Optimal Property Group, 2019)

P

Public rental housing

‘Public housing is a form of long-term rental social housing in Hong Kong and other markets.’ (HousingVic, 2018)

S

Subprime mortgage

‘A subprime mortgage is a type of loan granted to individuals with poor credit scores (640 or less, and often below 600), who, as a result of their deficient credit histories, would not be able to qualify for conventional mortgages. Because subprime borrowers present a higher risk for lenders, subprime mortgages usually charge interest rates above the prime lending rate.’ (Heyford, 2019)

T

Tenants Purchase Scheme

‘The Tenants Purchase Scheme (TPS) was introduced by the Housing Authority's (HA) in 1998. In 2002, the Government reviewed its overall housing policy. In support of the Government's repositioned housing policy, the HA terminated the TPS after the sale of TPS Phase 6B in 2005 / 2006. According to prevailing policy, tenants in the existing TPS estates can still opt to purchase their flats.’ (Hong Kong Housing Authority, 2019)

T

The Tragedy of Commons

1. ‘The tragedy of the commons is an economic problem in which every individual has an incentive to consume a resource at the expense of every other individual with no way to exclude anyone from consuming. It results in overconsumption, under investment, and ultimately depletion of the resource. As the demand for the resource overwhelms the supply, every individual who consumes an additional unit directly harms others who can no longer enjoy the benefits. Generally, the resource of interest is easily available to all individuals; the tragedy of the commons occurs when individuals neglect the well-being of society in the pursuit of personal gain.’ (Chappelow, 2019)

2. In Town Planning:

- ‘In the tragedy of the community, the members of the community fail to protect the boundary between individual and collective rationality

- In the tragedy of the government, the land management authority establishes an unlimited bureaucracy and disrespects the boundary drawn by individual liberty and community values

- In the tragedy of the individualist, the private landowners use their land as they deem fit...the free land uses breach the legitimate interests of other members of society.’ (Davy, 2012, p.13)

T

Too big to fail

‘"Too big to fail" describes a concept in which the government will intervene in situations where a business has become so deeply ingrained in the functionality of an economy that its failure would be disastrous to the economy at large. If such a company fails, it would likely have a catastrophic ripple effect throughout the economy. The failure may cause problems with companies which rely on the failing company's business as a customer as well as problems with unemployment as workers lose their jobs. Conceptually, in these situations, the government will consider the costs of a bailout in comparison to the costs of allowing economic failure in a decision to allocate funds for help.’ (Young, 2019)

Reference List

Angel, S. (2000). The Enabling Approach to Governing Housing. Housing Policy Matters: A Global Analysis. Oxford University Press. Retrieved from https://books.google.com.hk/books?id=nq_JqHcR12AC&pg=PA11&dq=The+housing+policy+environment+is+the+set+of+government+interventions+that+have+a+critical+and+measurable+effect+on+the+performance+of+the+housing+sector&hl=zh-TW&sa=X&ved=0ahUKEwih9Mm7k9DiAhWDMt4KHSa_CMEQ6AEIKTAA#v=onepage&q=The%20housing%20policy%20environment%20is%20the%20set%20of%20government%20interventions%20that%20have%20a%20critical%20and%20measurable%20effect%20on%20the%20performance%20of%20the%20housing%20sector&f=false

Angel, S. (2001). The Housing Policy Assessment and Its Application to Panama. Journal of Housing Economics, 10(2), p.176-209.

Central Provident Fund Board. (2019). CPF Overview. Retrieved from https://www.cpf.gov.sg/Members/AboutUs/about-us-info/cpf-overview

Chappelow, J. (2019). Tragedy Of The Commons. In Investopedia. Retrieved from https://www.investopedia.com/terms/t/tragedy-of-the-commons.asp

Chen, J. (2019). Inflation. In Investopedia. Retrieved from https://www.investopedia.com/terms/i/inflation.asp

Davy, B. (2012). Land Policy: Planning and the Spatial Consequences of Property. England: Ashgate. Retrieved from https://books.google.com.hk/books?id=jpkKrtrBALIC&pg=PA12&lpg=PA12&dq=Acting+according+only+to+their+own+rationality,+each+one+of+the+three+actors+fails+as+a+policymaker.+This+is+tragic&source=bl&ots=m3jFUZQ2P4&sig=ACfU3U3ZBJ__YRQEmxlQnlZoSLllqBE8wg&hl=zh-TW&sa=X&ved=2ahUKEwi3j9fmmeniAhUDEqYKHXj0CpkQ6AEwBnoECAYQAQ#v=onepage&q=Acting%20according%20only%20to%20their%20own%20rationality%2C%20each%20one%20of%20the%20three%20actors%20fails%20as%20a%20policymaker.%20This%20is%20tragic&f=false

DeSalvo, J.S. (2007). Teaching the DiPasquale-Wheaton Model, p.7. Retrieved from http://economics.usf.edu/PDF/Teaching%20the%20DiPasquale-Wheaton%20Model.pdf

Fair Labour Association. (2015). Housing Provident Fund in China. Retrieved from https://www.fairlabor.org/report/housing-provident-fund-china

HRBEK Law. (2019). What is a Pre-Sale Agreement? Retrieved from https://www.hrbeklaw.com/what-is-a-pre-sale-agreement.html

Hayes, A. (2019). Loan-to-value Ratio – LTV Ratio. In Investopedia. Retrieved from https://www.investopedia.com/terms/l/loantovalue.asp

Heyford, S.C. (2019). The Risk of Subprime Mortgage by a New Name. In Investopedia. Retrieved from https://www.investopedia.com/ask/answers/07/subprime-mortgage.asp

Home Ownership Scheme. (n.d.). In Wikipedia. Retrieved from https://en.wikipedia.org/wiki/Home_Ownership_Scheme

Hong Kong Green Building Council. (2019). What is Green Building. Retrieved from https://www.hkgbc.org.hk/eng/greenbuilding.aspx

Hong Kong Housing Authority. (2019). Buying a Flat under TPS. Retrieved from https://www.housingauthority.gov.hk/en/home-ownership/buying-a-flat-under-tps/index.html

Hong Kong Monetary Authority. (2018). Linked Exchange Rate System. Retrieved from https://www.hkma.gov.hk/eng/key-functions/monetary-stability/linked-exchange-rate-system.shtml

HousingVic. (2018). Public Housing. Retrieved from https://housing.vic.gov.au/public-housing

Information Services Department. (2008, June 4). LCQ14: The Housing Subsidy Policy[Press release]. Retrieved from https://www.news.gov.hk/eng/about/index.html

Kagan, J. (2018). Mortgage Interest Deduction. In Investopedia. Retrieved from https://www.investopedia.com/terms/home-mortgage-interest.asp

Kenton, W. (2019). Housing Bubble. In Investopedia. Retrieved from https://www.investopedia.com/terms/h/housing_bubble.asp

Murphy, C.B. (2019). Debt-To-Income Ratio – DTI. In Investopedia. Retrieved from https://www.investopedia.com/terms/d/dti.asp

Optimal Property Group. (2019). Understanding the Property Cycle. Retrieved from http://optimalprop.com/understanding-property-cycle/

Pacione, M. (2009). Housing. International Encyclopedia of Human Geography, p.196-200.

Proptiger. (2015). An Explainer: Price-To-Income Ratio. Retrieved from https://www.proptiger.com/guide/post/term-of-the-week-price-to-income-ratio

Urban Research Centre, University of Western Sydney. (2008). Housing affordability literature review and affordable housing program audit. Retrieved from http://www.uws.edu.au/__data/assets/pdf_file/0004/164623/landcom_report_2008-07-21.pdf

Young, J. (2019). Too Big To Fail. In Investopedia. Retrieved from https://www.investopedia.com/terms/t/too-big-to-fail.asp